-

Employee Info Center

- How does a new hire employee begin paperless onboarding ?

- Training Tutorials and Demonstrations - Employee

- Payroll & Benefits Onboarding for New Hires

-

- Welcome Employees

- What Does AdvanStaff HR Do For You?

- Payroll & Benefits Onboarding for New Hires

- Employee Portal (ESS)

- Employee Mobile App

- Understanding Your Employee Benefits

- Employee Training & Informative Videos

- Report a workplace injury

- Report a Workplace Concern

- How does a new hire employee begin paperless onboarding ?

-

- Employee Handbooks

- What are your office hours?

- Account Security & Multi-Factor Authentication (MFA)

- Email Address Requirements

- What is the status of my job application?

- Employment & Salary Verifications

- How does a new hire employee begin paperless onboarding ?

- Employee Support

- Payroll & Benefits Onboarding for New Hires

- Report a Workplace Concern

-

- I forgot my web username, can I reset it?

- How do I reset my web password?

- What is an Account Access Confirmation?

- Employee Self-Service Portal Access

- Why can't I get my SECURITY CODE for Employee Self Service Account Access?

- Employee Portal (ESS)

- How do I disable pop-up blockers?

- Employee Social Security Number (SSN) Edits

- How does a new hire employee begin paperless onboarding ?

- Payroll & Benefits Onboarding for New Hires

-

- All Benefits & Perks

- Wages on Demand - Earned Wage Access

- FinFit - Personal Financial Tools for Employees

- AT&T Wireless Discounts

- Corporate & Personal Travel Deals You Can't Find Anywhere Else

- MetLaw Legal Plans

- MyPetProtection Insurance

- Auto and Home Insurance (Save 15%)

- MetLife Aura Identity Theft Plans

-

- All Benefits & Perks

- Understanding Your Employee Benefits

- How To Save On Medical costs

- Open Enrollment

- Qualifying Life Event (QLE)

- Why isn't the benefit enrollment portal opening for me in the Employee Portal?

- Who can I add as a dependent for my benefit coverage?

- Benefit Basics Video

- Annual Plan Contribution Limits

-

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

- Instant Decision, Affordable Life Insurance

- Whole Life Insurance with Long-Term Care

- Group Dental Insurance (MetLife)

- Group Vision Insurance (MetLife)

-

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

- MetLaw Legal Plans

- MyPetProtection Insurance

- Accident Insurance (MetLife)

- Hospital Indemnity Insurance (MetLife)

- Critical Illness Insurance (MetLife)

- Short-term and Long-term Disability Insurance (MetLife)

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Instant Decision, Affordable Life Insurance

- Voluntary Benefit Programs

- Whole Life Insurance with Long-Term Care

- MetLife Aura Identity Theft Plans

-

- Annual Plan Contribution Limits

- Flex Spending Accounts

- Medical Expense FSA

- Premium Only Plan FSA

- Dependent Care FSA

- Commuter, transit, and parking FSA

- Health Savings Accounts (HSA)

- Limited Purpose Flex Spending Account (LPFSA)

- FSA - Member Portal (year 2020 and previous)

- How To Save On Medical costs

-

Manager Info Center

-

- Employee Onboarding

- 401k Retirement Plan Services

- Employment & Salary Verifications

- Leave Requests: PTO Tracking & Approvals

- Employee Earned Wage Access (EWA)

- Corporate & Personal Travel Deals You Can't Find Anywhere Else

- Document Management System (DMS)

- Workers Compensation Program and Policy Administration

-

- Learning Management System (LMS)

- Performance Management (PM)

- Background and Drug Testing

- Applicant Tracking System (ATS)

- Short-term Payroll Funding

- R&D Tax Credit (R&D)

- Work Opportunity Tax Credit (WOTC)

- Employee Portal Messaging-Alerts

- Business Insurance

- Labor Poster Compliance Solutions for Local and Remote Workers

-

- Full-Service Payroll & Employment Tax Administration

- Time Keeping Solutions Introduction

- Onboarding Your New Hire onto the Payroll System

- Workers Compensation Program and Policy Administration

- Labor Poster Compliance Solutions for Local and Remote Workers

- Employee Handbook Program (Core+)

- FMLA Compliance

- Affordable Care Act (ACA) Compliance

- Workplace Safety Program Assistance

- HR Toolkit

-

- Full-Service Payroll & Employment Tax Administration

- Submitting Payroll Hours, Salary, Commissions, etc.

- Payroll Timesheet Imports

- Minimum Wage Map

- Direct Deposit

- Employee Earned Wage Access (EWA)

- Pre-paid VISA Paycard

- Employment & Salary Verifications

- Office Schedule, Payroll Processing Cutoff Dates, Federal Reserve Bank Holidays, System Maintenance Schedule

-

- Employee Onboarding

- Employee Termination Processing

- How do I process the paperless I-9?

- I-9 Part 2 Approval Guide

- Background and Drug Testing

- Unemployment Processing

- Onboarding Your New Hire onto the Payroll System

- RE-HIRES

- How does a new hire employee begin paperless onboarding ?

- Payroll & Benefits Onboarding for New Hires

-

- Employee Benefit Plan Administration

- All Benefits & Perks

- Flex Spending Accounts

- 401k Retirement Plan Services

- Employee Assistance, Wellness, and Lifestyle Programs (EAP)

- Affordable Care Act (ACA) Compliance

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Voluntary Benefit Programs

- FinFit - Financial EAP

-

- Workers Compensation Program and Policy Administration

- Claims Management and Administration Assistance

- Workplace Safety Program Assistance

- Report a workplace injury

- Report a Workplace Concern

- WC CLAIMS FORMS BY STATE

- Employment Practice Liability Insurance (EPLI)

- Secure Upload Documents

- Business Insurance

-

- Employee Record Maintenance in the Manager Portal

- Manager Training Video Library

- Document Management System (DMS)

- Employee Portal Messaging-Alerts

- Employee Portal Event Management

- Manager Portal Training - The Basics

- I-9 Part 2 Approval Guide

- Training Support located inside the Manager Portal

- Employee Social Security Number (SSN) Edits

- Training Tutorials and Demonstrations - Worksite Managers and Administrators

Attention!

Starting with the 2022 Plan year, FSA and Transportation participants are allowed to rollover unused funds from year to year according to IRS limits. View plan limits HERE.

Flex-Spending Accounts

Save money on every paycheck by reducing taxes through covered expenses

Types of Flex Spending Accounts Available

AdvanStaff offers many types of FSA account so employees can lower taxes and take home as much money as possible.

The FSA plan types are as follows:

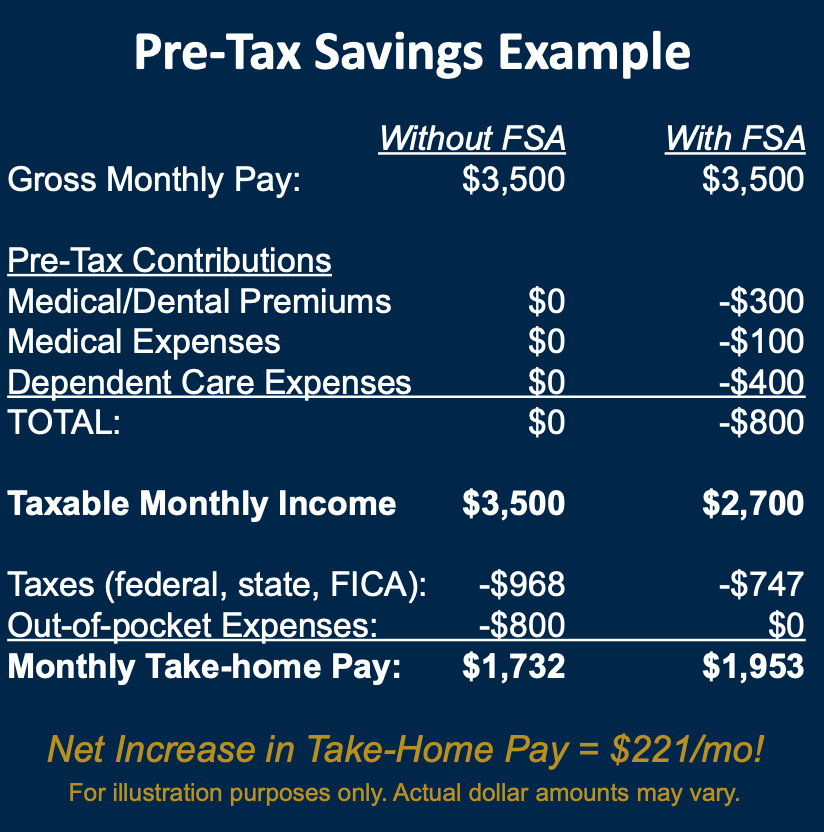

Increase Your Take-Home Pay by Reducing Your Taxable Income!

A Flexible Spending Account (FSA) allows you to save up to 30% on your eligible healthcare, dependent care, business parking, and commuting expenses every year by using pre- tax dollars.

Consider how much you spend each year on the following:

- payroll-deducted premiums for qualified employer benefit programs

- prescription drugs/medications/vaccinations

- medical/dental office visits

- eye exams and prescription glasses/lenses

- daycare tuition

- Business parking and commuting

Why not reduce these expenses by using pre- tax dollars instead of after-tax dollars?

With rising healthcare costs, every penny counts! By using pre-tax dollars, you are taxed on a lower gross salary, thereby saving money that would otherwise be spent on federal, state and FICA taxes, and so you increase your take home pay!

FSA Frequently Asked Questions

The FSA is offered through your employer and administered by AdvanStaff HR. When you choose to enroll in FSA plan, you decide the dollar amount you want to contribute to each account based on your estimated expenses for the upcoming year. The funds will be deducted pre-tax in equal amounts from each paycheck throughout the plan year. For every dollar you put into these accounts, the more money you save by paying less in taxes.

As you incur eligible expenses, you simply use the supplied VISA to direct pay the service or product provider up to the amount of your annual contribution.

You may also elect to receive a reimbursement directly to your bank account if you decide or can’t use the provided card for direct pay.

You can access your account from within the Employee Portal.

Login to the Employee Portal -> Benefits -> Flex Spending (OMEGA FSA)

When can I enroll?

You can enroll upon being hired by your employer, or annually during open enrollment which is generally Nov 1 – 30 for the following plan year.

Accessing the pre-tax funds in our account is easy. Simply present the VISA pay-card given to you by AdvanStaff HR shortly after you enroll. You can direct pay any vendor that accepts card payment. No reimbursement required.

You can also upload paid receipts via the employee portal and we will deposit the funds directly to your bank account on file.

Use the AdvanStaff HR Employee portal to do the following:

- View account and check balance

- Make an HSA contribution or distribution

- Enter and track expenses

- Make a payment from your account

- file FSA/HRA claims with receipt images

- Scan or view eligible expenses, and more!

At the time of enrollment, or during annual open enrollment, you are eligible to make an annual election on how much to save from each paycheck.

AdvanStaff will deduct those equal amounts each pay period BEFORE taxes are paid, so you wont be paying taxes on the amounts. We will then deposit the amounts into a special account linked to a VISA debit card for you to conveniently use for covered expenses.

Health Savings Accounts (HSAs) are generally funded by the employer and/or the employee.

- Understand the IRS contribution limits

for your Plan during the Plan year (available at the online enrollment site). - Review the eligible and ineligible expense lists for Healthcare FSA and Dependent Care FSA.

- Determine which eligible expenses you expect to incur during the Plan year and how much you will spend.

- The total amount you project to be spent on eligible healthcare and/or dependent care expenses during the Plan year is the amount you should contribute to your FSA.

FSA Funds Rollover:

Startingin 2022, the AdvanStaff FSA plan allows the maximum IRS limit to rollover funds from one year to the next.

The plan year is one full year (365 days) and generally begins on the first of a month. AdvanStaff HRs plan runs for an entire calendar year, January 1 to December 31.

The grace period is 90 days (up until March 31st of the following year) which employees may use up any funds remaining at the end of the plan year. For FSA and Transportation Accounts, the unused funds will be rolled over to the following plan year according to IRS determined limits.

Deadlines:

Allowable expenses must be incurred January 1 – December 31.

All reimbursements must be claimed no later than March 31 for the previous plan year.

This rule states that any funds remaining in the participating employee’s FSA account at the end of the plan year will be forfeited to the employer. Although the rule is clear, many users of an FSA largely misunderstand the result of the rule: loss of funds can be easily avoided.

Let’s look at an example:

Joe Smith chooses to participate in the Medical FSA and elects to fund $500 for the year. After the plan year and grace period are complete, Joe finds that he spent only $400 of the original $500 he put away. He fears he has lost $100, but due to the taxes he saved on the $500 he has not. Let’s say Joe is in the 28% tax bracket. By putting $500 away in his Medical FSA, he saved $140 in taxes (money that was not taken out of his paycheck and given to the IRS). In sum, even if Joe leaves $100 in his Medical FSA account, he has still saved $40! This vital key issue must be explained completely to potential FSA participants.

Employees who participate in an FSA should determine the amount to fund by looking at the expenses they will incur in a year; this amount is not an arbitrary number.

In this example, let’s say Mary Johnson is married with two children. One child is in daycare, Mary has glasses, and her husband Tom has allergies. When adding up how much to put away in her Medical and Dependent Care FSA accounts, Mary looks ahead for the year and determines that one child is going to need braces (add $2,000), that Mary is going to need glasses (add $500), and that Tom has a regular prescription for allergy medicine every month (add $120: $10 per month co-pay). Adding it all up, she determines her expenses add up to $5,000 for day care and $2,620 for medical expenses. Since the limit on the medical FSA for 2022 is $2,850, Mary will elect $2,850 for the Medical FSA and $5,000 for the Dependent Care FSA. The total amount she will put away toward her FSA is $7,850. These are expenses she knows will be incurred. Once again, at an average 28% tax bracket, Mary will save $2,270 by using her FSA! That is equivalent to getting her child’s braces for free! She has no doubt that she should take advantage of her FSA and save this money.

Cafeteria Plans are qualified, non-discriminatory benefit plans, meaning a discrimination test must be met based on the elections of the participants combined with any contribution by the employer.

You may change your FSA elections during the Plan year only if you experience a change of status such as:

- a marriage or divorce

- birth or adoption of a child, or

- a change in employment status

Refer to the Change of Election Form (available from your employer) for a complete list of circumstances acceptable for changing elections mid-year.