-

Employee Info Center

- How does a new hire employee begin paperless onboarding ?

- Training Tutorials and Demonstrations - Employee

- Payroll & Benefits Onboarding for New Hires

-

- Welcome Employees

- What Does AdvanStaff HR Do For You?

- Payroll & Benefits Onboarding for New Hires

- Employee Portal (ESS)

- Employee Mobile App

- Understanding Your Employee Benefits

- Employee Training & Informative Videos

- Report a workplace injury

- Report a Workplace Concern

- How does a new hire employee begin paperless onboarding ?

-

- Employee Handbooks

- What are your office hours?

- Account Security & Multi-Factor Authentication (MFA)

- Email Address Requirements

- What is the status of my job application?

- Employment & Salary Verifications

- How does a new hire employee begin paperless onboarding ?

- Employee Support

- Payroll & Benefits Onboarding for New Hires

- Report a Workplace Concern

-

- I forgot my web username, can I reset it?

- How do I reset my web password?

- What is an Account Access Confirmation?

- Employee Self-Service Portal Access

- Why can't I get my SECURITY CODE for Employee Self Service Account Access?

- Employee Portal (ESS)

- How do I disable pop-up blockers?

- Employee Social Security Number (SSN) Edits

- How does a new hire employee begin paperless onboarding ?

- Payroll & Benefits Onboarding for New Hires

-

- All Benefits & Perks

- Wages on Demand - Earned Wage Access

- FinFit - Personal Financial Tools for Employees

- AT&T Wireless Discounts

- Corporate & Personal Travel Deals You Can't Find Anywhere Else

- MetLaw Legal Plans

- MyPetProtection Insurance

- Auto and Home Insurance (Save 15%)

- MetLife Aura Identity Theft Plans

-

- All Benefits & Perks

- Understanding Your Employee Benefits

- How To Save On Medical costs

- Open Enrollment

- Qualifying Life Event (QLE)

- Why isn't the benefit enrollment portal opening for me in the Employee Portal?

- Who can I add as a dependent for my benefit coverage?

- Benefit Basics Video

- Annual Plan Contribution Limits

-

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

- Instant Decision, Affordable Life Insurance

- Whole Life Insurance with Long-Term Care

- Group Dental Insurance (MetLife)

- Group Vision Insurance (MetLife)

-

- Voluntary Health: Physician, Urgent Care, Hospital, Dental, Vision, and Wellness Benefits, Inpatient, $0 Telemed (Hooray Health)

- WellCall360 - Voluntary Wellness + 0$ Tele-med, Rx, Dental, Vision (Hooray Health)

- MetLaw Legal Plans

- MyPetProtection Insurance

- Accident Insurance (MetLife)

- Hospital Indemnity Insurance (MetLife)

- Critical Illness Insurance (MetLife)

- Short-term and Long-term Disability Insurance (MetLife)

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Instant Decision, Affordable Life Insurance

- Voluntary Benefit Programs

- Whole Life Insurance with Long-Term Care

- MetLife Aura Identity Theft Plans

-

- Annual Plan Contribution Limits

- Flex Spending Accounts

- Medical Expense FSA

- Premium Only Plan FSA

- Dependent Care FSA

- Commuter, transit, and parking FSA

- Health Savings Accounts (HSA)

- Limited Purpose Flex Spending Account (LPFSA)

- FSA - Member Portal (year 2020 and previous)

- How To Save On Medical costs

-

Manager Info Center

-

- Employee Onboarding

- 401k Retirement Plan Services

- Employment & Salary Verifications

- Leave Requests: PTO Tracking & Approvals

- Employee Earned Wage Access (EWA)

- Corporate & Personal Travel Deals You Can't Find Anywhere Else

- Document Management System (DMS)

- Workers Compensation Program and Policy Administration

-

- Learning Management System (LMS)

- Performance Management (PM)

- Background and Drug Testing

- Applicant Tracking System (ATS)

- Short-term Payroll Funding

- R&D Tax Credit (R&D)

- Work Opportunity Tax Credit (WOTC)

- Employee Portal Messaging-Alerts

- Business Insurance

- Labor Poster Compliance Solutions for Local and Remote Workers

-

- Full-Service Payroll & Employment Tax Administration

- Time Keeping Solutions Introduction

- Onboarding Your New Hire onto the Payroll System

- Workers Compensation Program and Policy Administration

- Labor Poster Compliance Solutions for Local and Remote Workers

- Employee Handbook Program (Core+)

- FMLA Compliance

- Affordable Care Act (ACA) Compliance

- Workplace Safety Program Assistance

- HR Toolkit

-

- Full-Service Payroll & Employment Tax Administration

- Submitting Payroll Hours, Salary, Commissions, etc.

- Payroll Timesheet Imports

- Minimum Wage Map

- Direct Deposit

- Employee Earned Wage Access (EWA)

- Pre-paid VISA Paycard

- Employment & Salary Verifications

- Office Schedule, Payroll Processing Cutoff Dates, Federal Reserve Bank Holidays, System Maintenance Schedule

-

- Employee Onboarding

- Employee Termination Processing

- How do I process the paperless I-9?

- I-9 Part 2 Approval Guide

- Background and Drug Testing

- Unemployment Processing

- Onboarding Your New Hire onto the Payroll System

- RE-HIRES

- How does a new hire employee begin paperless onboarding ?

- Payroll & Benefits Onboarding for New Hires

-

- Employee Benefit Plan Administration

- All Benefits & Perks

- Flex Spending Accounts

- 401k Retirement Plan Services

- Employee Assistance, Wellness, and Lifestyle Programs (EAP)

- Affordable Care Act (ACA) Compliance

- Group & Voluntary Life Insurance Coverage for Dependents (MetLife)

- Voluntary Benefit Programs

- FinFit - Financial EAP

-

- Workers Compensation Program and Policy Administration

- Claims Management and Administration Assistance

- Workplace Safety Program Assistance

- Report a workplace injury

- Report a Workplace Concern

- WC CLAIMS FORMS BY STATE

- Employment Practice Liability Insurance (EPLI)

- Secure Upload Documents

- Business Insurance

-

- Employee Record Maintenance in the Manager Portal

- Manager Training Video Library

- Document Management System (DMS)

- Employee Portal Messaging-Alerts

- Employee Portal Event Management

- Manager Portal Training - The Basics

- I-9 Part 2 Approval Guide

- Training Support located inside the Manager Portal

- Employee Social Security Number (SSN) Edits

- Training Tutorials and Demonstrations - Worksite Managers and Administrators

401k Retirement Savings

w/ Slavic401k

It’s time for you to take responsibility for your future.

After all, if you don’t, who will?

Pay Yourself Before Uncle Sam.

Let’s face it. Relying on Social Security to sustain you during retirement just isn’t a viable option anymore. Increasingly, today’s workers are taking ownership of their own financial futures by investing in a 401(k) plan.

Plan Participant Resources & Tools

A 401(k) plan is an EXCELLENT way to save for retirement. Following are a few additional benefits of a 401(k) program:

- Employer matching contributions. When you save using a 401(k) your employer may also contribute to your plan. This is FREE money boosting an immediate gain in your account balance.

- Tax-deferred growth. Funds in your employers 401(k) plan grow tax-deferred meaning you wont pay taxes until you withdraw amounts during retirement.

- Automatic savings. At your direction, AdvanStaff HR will deduct the amount you elect to save directly from your paycheck and we will remit the deposit to be invested according to your investment sections.

- Taxable advantages. Traditional 401(k) contributions are taken out of your paycheck before taxes are deducted from your paycheck. That means gross income is reduced, so you pay less in income taxes. Roth 401(k) contributions are post-tax deductions which means taxable income is NOT reduced. However, Roth balances are not taxed at time of distribution during retirement.

Investing as little as the cost of going out to eat once every paycheck can result in a very healthy 401(k) account balance over the course of a few decades.

Frequently Asked Questions

Notification

Employees will receive an eligibility notice by mail several weeks before they can enroll lin the 401k program. They can enroll at any time, but deductions will not start until the proper entry date occurs.

Entry Date

The entry date for the 401k program is the 1st day of each quarter (Jan 1, April 1, July 1, Oct 1.). Enrollment either online (recommended) or via a paper packet must be completed BEFORE the entry date.

We offer two options to enroll.

Option 1

To start, login to the Employee Portal.

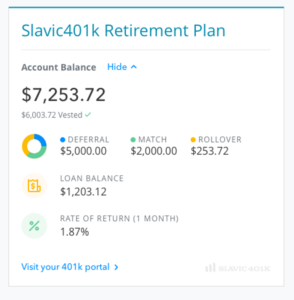

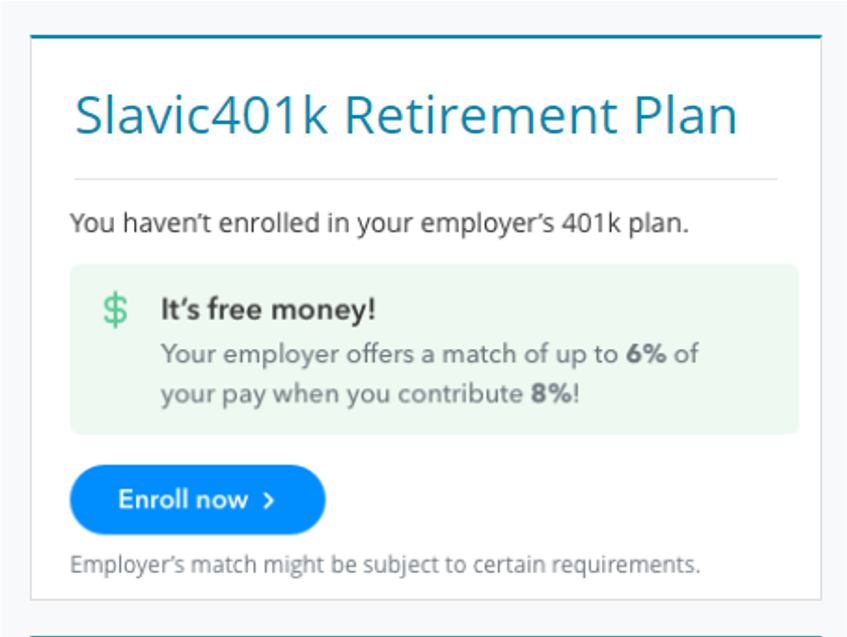

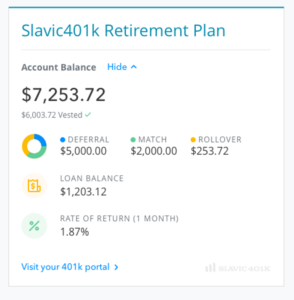

If your worksite employer offers a 401k plan, you will see a 401k tile on your employee portal dashboard that looks like this:

If you are eligible but not participating:

If you are already participating:

Simply click on the “Enroll Now” button to get started.

Once you are logged in to your private account, you can:

- elect your contributions

- decide if you want to participate in a traditional 401k or Roth 401k

- choose your investments (consider Bespoke services)

- designate your beneficiaries

- finalize your enrollment

The entire process is paperless, simple, and fast!

Option 2

You can also enroll via the Slavic401.com website.

We have an enrollment guide below. Many steps can be eliminated if you click on the dashboard widget link inside the AdvanStaff HR employee portal.

Accessing your account couldn’t be any easier.

Option 1

Simply log into the Employee Portal and look for the 401k dashboard tile. It should look something like this:

Click on the “Visit your 401k portal” link and you will automatically be taken to your 401k account.

The portal allows you account access 24 x 7 to:

- Make instant adjustments to your 401(k) plan

- Track your investment in real-time

- Manage any aspect of your 401(k) account

- and much, much more!

Option 2

If you don’t have access to the employee portal, you can also log in to the Slavic 401k website directly.

Limit change from year to year. You can view all tax-advantage plan limits here:

Traditional vs. Roth: What’s the Difference?

In addition to a traditional 401(k), your employer has added the Roth 401(k) deferral option to your retirement plan.

In a traditional 401(k) plan, contributions are made with before-tax dollars. The money is not taxed while it remains in your account, but every dollar taken out is taxed as ordinary income. Contributions to a Roth 401(k) are made with after-tax dollars, so initially they won’t reduce your tax bill. However, the money will grow tax- free, and all withdrawals after age 59 1/2 will be tax-free. In other words: A regular 401(k) plan gives you a tax break on the front end, the Roth 401(k) gives it to you on the back end.

Which is Right for You?

There is no one-size-fits-all answer. Instead, the right answer for you will depend on your current tax situation and whether your tax rate is likely to be higher or lower in retirement.

Since you don’t pay any taxes on Roth withdrawals, the higher your tax bracket in retirement, the more advantageous a Roth is likely to be. Strong savers—including those who contribute the maximum amount allowed by the IRS each year—are good Roth candidates because they are likely to have a bigger nest egg in retirement that can benefit from Roth’s tax-free withdrawals.

On the other hand, if you’re in a low tax bracket today, you might consider a Roth now, when a lowering of your gross income will not be as significant a tax benefit as it might be later on, if you find yourself in a higher bracket.

Because it comes right out of your paycheck, a Roth contribution is likely to reduce your take home pay by more than a similar contribution to a traditional 401(k), which is made using pre-tax dollars. If you want to save—and take home as much money as possible—a traditional 401(k) is perhaps the way to go.

Finally, since no one knows what tax rates will be in the future, diversifying with contributions to both a traditional 401(k) and Roth might be a way to hedge your tax bets with your retirement savings.

There are many variables to consider when deciding if a Roth 401k is right for you. We recommend that you speak to your tax accountant or financial professional to help determine if the Roth is appropriate for your circumstances.

You may contribute to one or both accounts, but you may not double up your contribution by having both types of 401(k) accounts. The same contribution limit will apply to either account, or both combined. If your employer provides a matching contribution, the match must be put into the traditional 401(k) account — subject to the regular 401(k) rules — even if you are directing all of your contributions into a Roth 401(k). Loans are not available in the Roth 401(k).

Participants have access to:

- Over 60 fund options,

- 10 target-date portfolio choices,

- Fund investment companies like Vanguard, Janus, Fidelity, Invesco, American Funds, Wells Fargo, and T. Rowe Price,

- Managed accounts through the “Bespoke” platform based on your risk tolerance and investment preferences.

The Bespoke Portfolio Service is a proprietary algorithm developed by Slavic401k. Bespoke is one of the first digital advisors built into a 401(k) platform.

The 401k program is built on the Fidelity investment platform.

Employees also have the option of using a fully self-directed brokerage account through Fidelity for investing in stocks, bonds, and other investment vehicles. Margin trading is not supported.

To enroll, please contact Slavic401k customer service by visiting their website or by calling a Slavic401k specialist at (800) 356-3009.

Slavic’s Bespoke Portfolio Service was carefully crafted with the participant-investor in mind. Bespoke allows you to lean on Slavic’s decades of technology and 401(k) investment expertise to put your money to work for you, no matter what stage of life you’re in.

Learn more about the powerful advantages of Slavic’s proprietary Bespoke Portfolio Service.

What is the Bespoke Portfolio Service?

The Bespoke Portfolio Service is a new investing tool created and provided by Slavic401k. Bespoke is one of the first digital advisors built into a 401(k) platform, and uses a proprietary algorithm to custom craft a retirement savings and investing plan that is unique to your individual goals and life circumstances. It is a fully integrated digital advisor that helps make retirement-readiness a reality.

How does Bespoke work?

Bespoke factors in your age, as well as your expected timeline to retirement, and makes a recommendation on how much to save, and how to escalate your savings rate over time to reach your goals. It provides a reasonable retirement savings target, and shows a clear path to reaching that target. Bespoke creates a custom retirement portfolio allocation, considering appropriate risk exposure and providing the balance of potential gain and portfolio stability. Additionally, Bespoke intelligently re-allocates your portfolio to become more conservative over time.

You can access and enroll in Bespoke Services by selecting the “Bespoke” menu item from within the 401k portal.

Why should I enroll in Bespoke?

Bespoke provides the benefit of expert financial advice through a fully automated and digital platform. You don’t have to become an expert investor, and you don’t need to pay expensive fees to get advice from a human financial advisor. Bespoke provides a clear and simple path to setting and reaching your retirement goals.

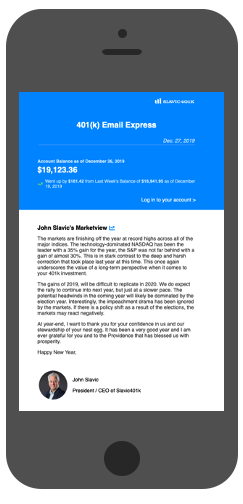

Keep an eye on your 401(k) investment with Email Express

You have the option of receiving an “Email Express” email that provides your 401(k) balance once a week.

When it comes to your 401(k) plan, knowledge is power.

Our Email Express™ program provides participants with weekly insights into the status of their individual account, as well as critical updates on market fluctuations and the direct impact those changes may have on your plan.

Weekly updates include:

- Brief Market Commentary

- 401(k) Account Balance

- Previous Week 401(k) Account Balance

Once you meet your employers waiting period, you can enroll in the 401(k) program, you will enter the program on the 1st day of the next calendar quarter. Every employer defines their own waiting period. If you have questions about your particular waiting period, please feel free to open a support ticket. A benefit specialist will research and respond right away.

Plan entry dates are as follows:

- January 1

- April 1

- July 1

- October 1

For example, if you enroll in the 401(k) plan on January 20th, your deductions will start to take place the payroll immediately dated after April 1st, the start of the next calendar quarter.

AdvanStaff HR has licensed advisors on staff to help with initial onboarding, enrollment, and many other functions.

When it comes to most account services, we recommend contacting the Slavic employee service team. The Slavic team has special access to your account and can help with nearly all requests.

Slavic401k Customer Service

(800) 356-3009

Live customer service staff is available to assist, Monday through Friday

8:00 am to 8:00 pm EST